Product/Project Cost Analysis

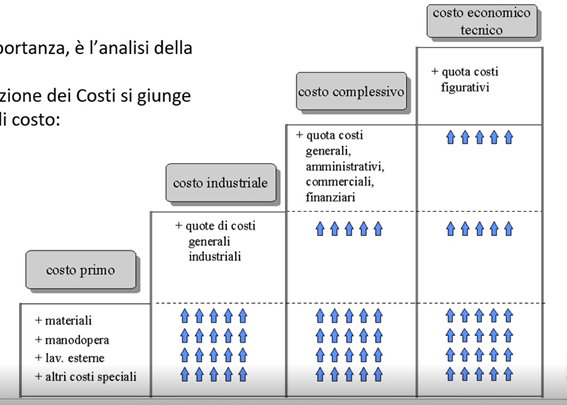

The last point, which represents the final objective of our control at least regarding the industrial accounting part, is the identification of the various margins of our products or our projects/orders. Generally, four cost configurations are employed:

FIRST COST: which considers only those costs directly attributable to the product or project. Generally, these are materials, labor, external processing, specific depreciation, thus everything that can objectively be attributed to the calculation object, whether it be product or project.

INDUSTRIAL COST: represents the second configuration through which we add general industrial cost shares to the first cost, which are those costs that are not directly allocatable but are necessary for the proper functioning of production itself.

TOTAL COST: adds to the industrial cost the so-called structural costs, which are general, administrative, commercial, and financial.

TECHNICAL ECONOMIC COST: represents the last configuration. The technical economic cost is not always used. The difference between the total cost and the technical economic cost lies in the fact that we add imputed charges. For example, instead of considering the depreciation charge of my technical property, I consider a market rental amount, even though it is owned by the company itself. Another example is the performance of the owner of the company, which is generally not quantified as it falls under the profit chapter, but in this case, it is quantified because it is considered as if he were an employee in all respects (thus providing a salary for the performance he carries out within the company).

In this sense, we can freely create N Reclassification Models for controlling, with the cost configurations deemed most suitable for the business reality.

To create alternative models, it is easy to duplicate an already existing one to extend it and consider additional costs.